Six Powerful Identity Protection Tips

Everywhere we turn, there’s another news story about a security breach at a major U.S. retailer or financial institution. Surprisingly, many of these companies had anti-hacker systems in place, but cybercriminals have discovered how to outsmart these technologies.

Everywhere we turn, there’s another news story about a security breach at a major U.S. retailer or financial institution. Surprisingly, many of these companies had anti-hacker systems in place, but cybercriminals have discovered how to outsmart these technologies.

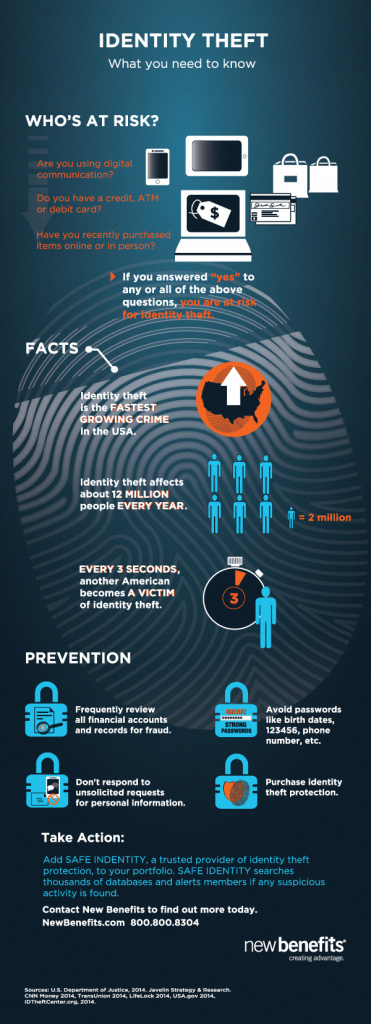

Identity theft is spreading like wildfire, impacting millions across the nation. In the past year, the personal data of 110 million Americans—half of U.S. adults—was compromised in some shape or form.* There’s no such thing as unbeatable cyber security—which is why we must be vigilant in monitoring our personal data and encouraging our clients to do the same.

I recently spent two days at an identity theft protection conference, hearing personal stories from journalists, security experts and regulators. I picked up useful tips and preventive measures to better protect myself and my company. I shared this information with employees at New Benefits and felt I had a responsibility to share it with our broker community as well.

A Rude Awakening

Today’s crafty cyber criminals are getting more imaginative, especially when it comes to nabbing personal data on smartphones and tablets. Cyber security experts say it’s inevitable that your personal information will be stolen—whether it’s your credit and debit cards, tax information, healthcare records or online bank account.

Businesses Beware

No matter the size of your business, you must prepare for the possibility of a data breach and proactively monitor the personal data of your customers, clients and employees. According to a Verizon study, 80% of hacking victims in the business community didn’t realize they’d been hacked until they were told by government investigators, vendors or customers. If you think hackers only target large companies, you are wrong. Small businesses are at risk as well and need to work with identity theft protection companies to protect their customers’ data.

Six Powerful Protection Tips

Here are six steps to protect your personal data and prepare your business for a security breach:

- Encrypt business and customer files using modern encryption software.

- Install robust anti-malware software on your business computers.

- Use a password manager—software that creates unique, strong passwords for each account.

- Educate your employees about phishing emails. Phishers stole $1 billion from small businesses in 2012.

- Keep backup copies of confidential files in case the data is stolen or destroyed.

- Proactively monitor your personal data and have a strong company behind you in the event something does happen. No different than an alarm system at your home, have an identity theft protection program monitoring your personal identity. Small businesses should work with a consultant to strengthen security measures for customer data.

Until next time, stay safe out there.

–Marti Powles, COO

Copyright © 2014 by New Benefits, Ltd. All rights reserved.

*As reported by Tim Pawlenty, president of the Financial Services Roundtable and former governor of Minnesota